Natural disasters and financial tightening provide dual threat to Commercial Real Estate in 2022.

There are multiple emerging headwinds threatening the commercial real estate market in 2022. Not since the Great Recession has there been such a significant disruption to the industry. While the pandemic and supply chain disruptions in 2020 both had impacts to the overall economy, prices rebounded quickly, and growth accelerated dramatically. However, there are now multiple large-scale threats to commercial property, both financial and climate related.

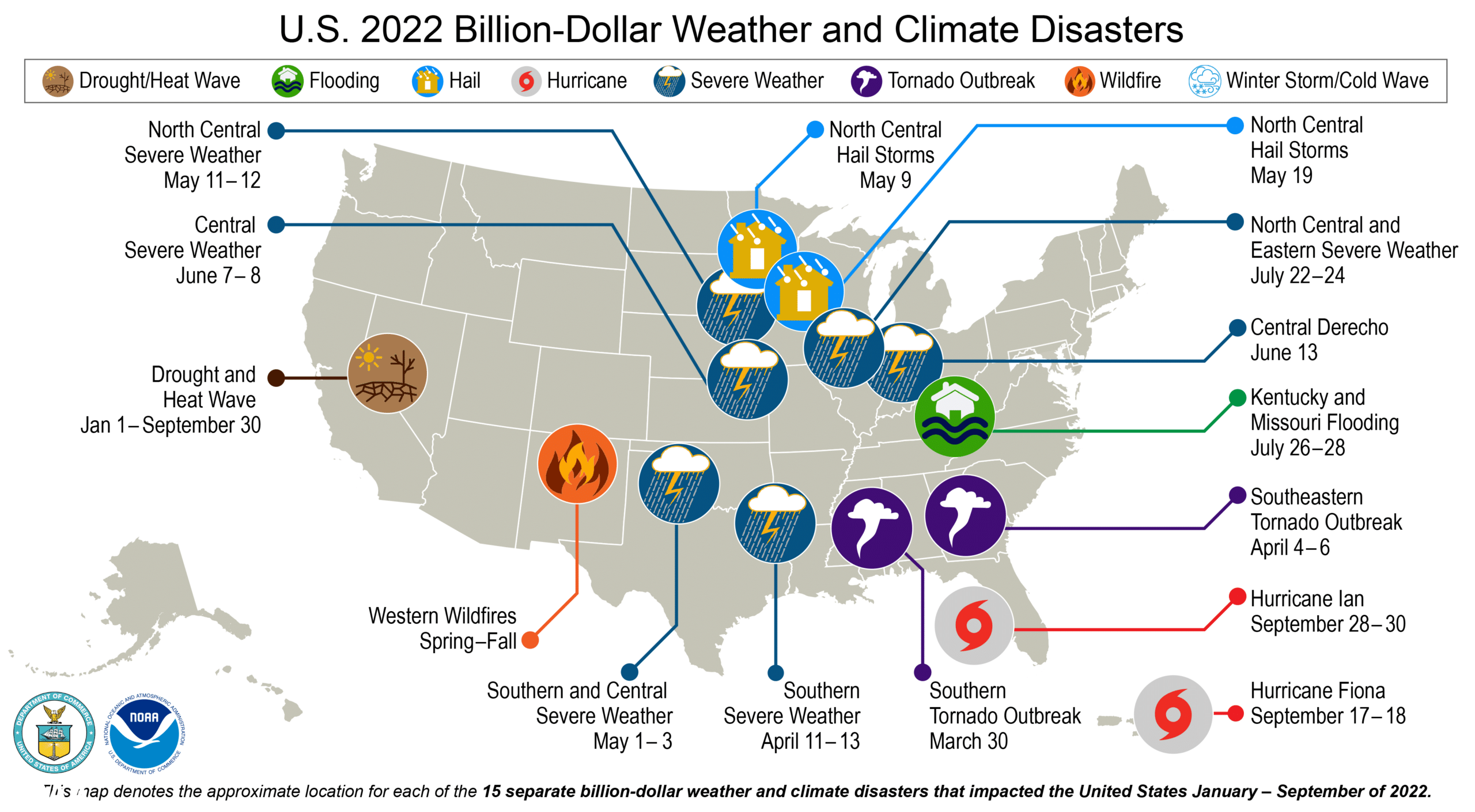

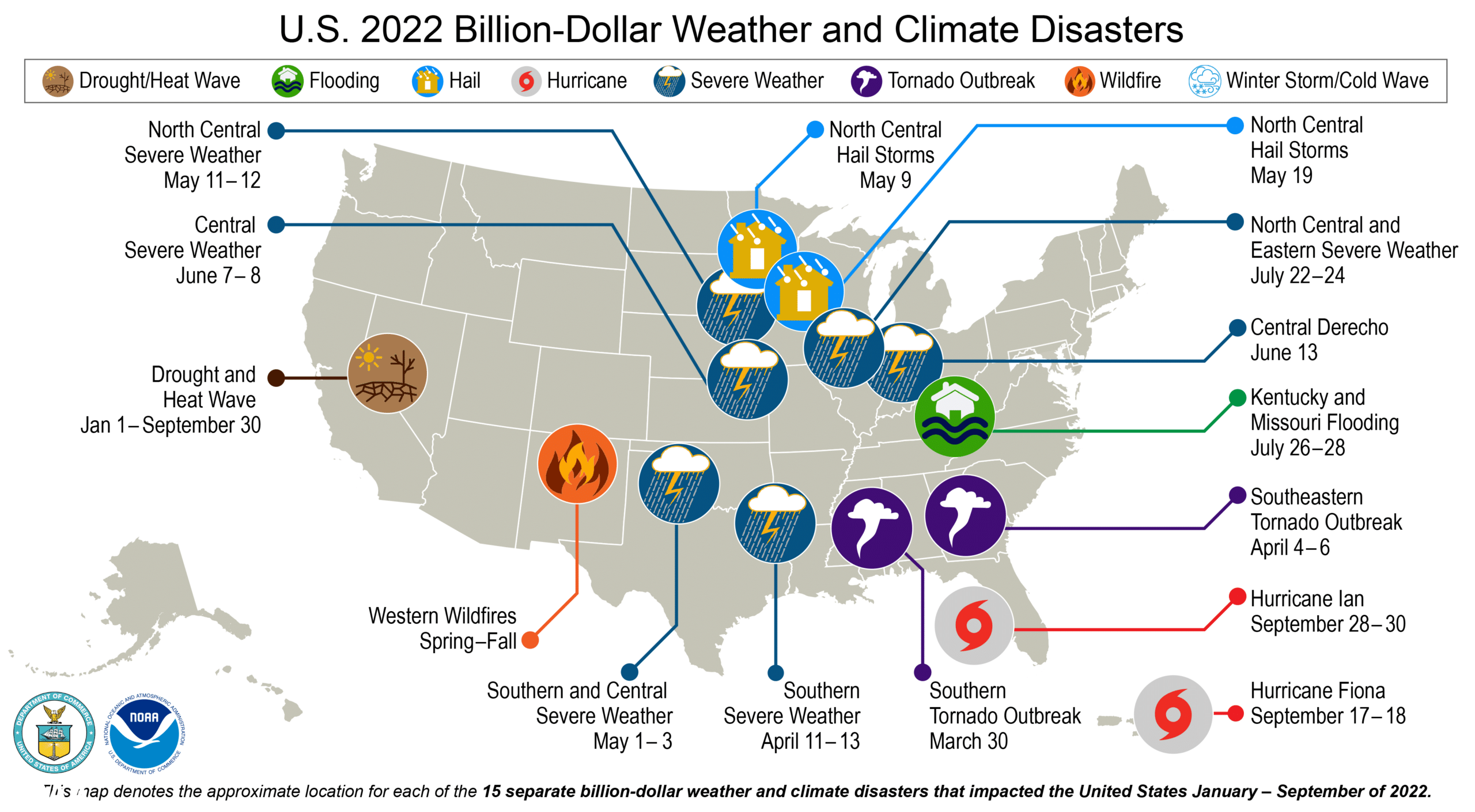

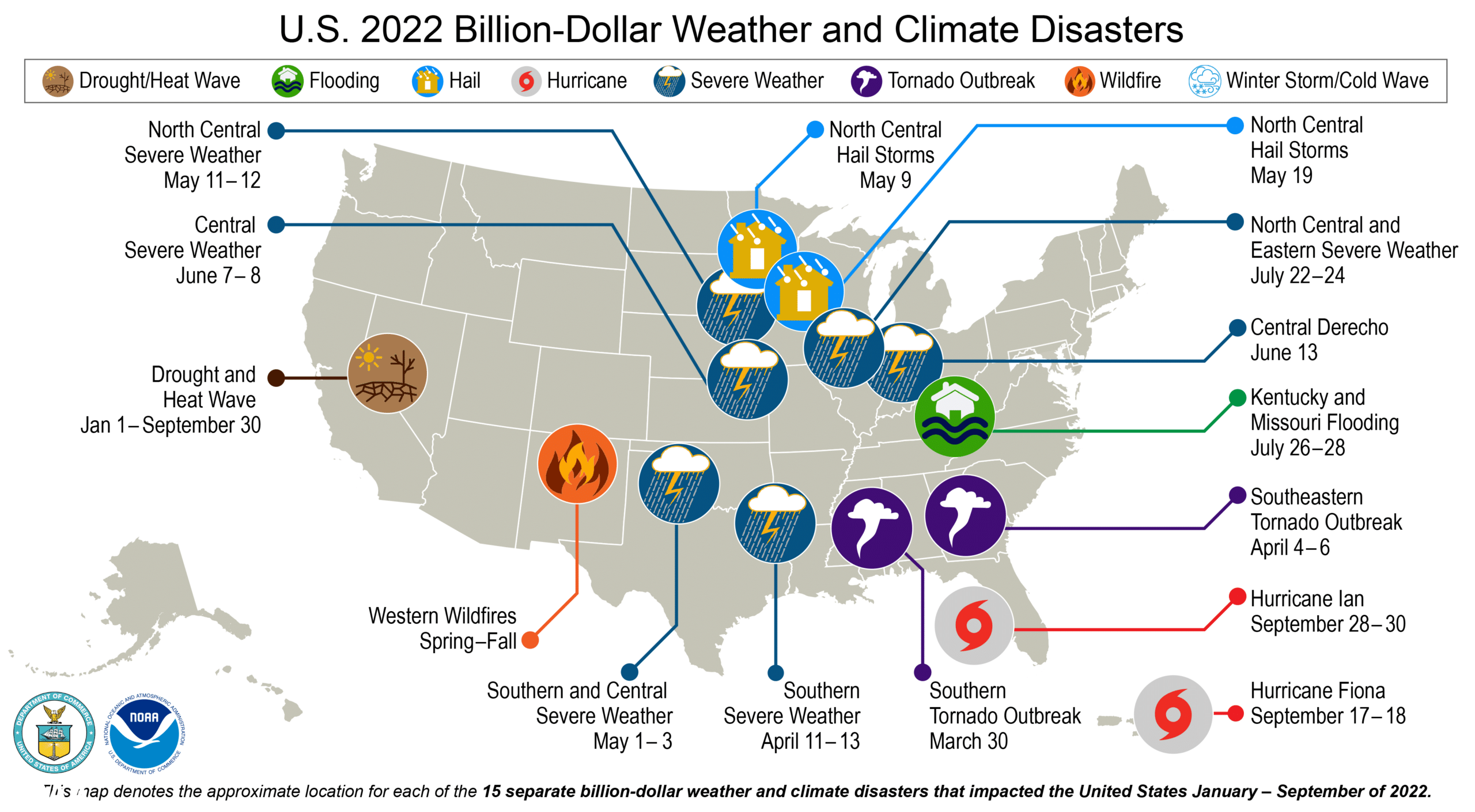

An 8th consecutive year of 10 separate billion-dollar disasters

The United States has already been impacted by 15 separate weather and climate disasters that each resulted in over $1 billion dollars in property and infrastructure damage in 2022. This report summarizing the first 9 months of the year comes from scientists at

NOAA’s National Centers for Environmental Information.

Total losses to commercial property, personal assets, residential real estate, and infrastructure damage is $29.3 billion in 2022 so far. Unfortunately, this figure does not yet include the costs for Hurricane Ian, the western wildfires, and Hurricane Fiona, which may push the 2022 total over $100 billion in losses. The United States has suffered

$100 billion in total disasters costs in four of the last five years.

Commercial Real Estate Sector Faces Risks as Financial Conditions Tighten

The commercial real estate sector has been on the mend since the end of 2020. Prices of industrial and residential properties surged globally in 2021 and early 2022. However, the momentum is losing steam as global financial conditions have tightened this year as central banks shift to hiking interest rates. In the 2Q of 2022 property prices in the industrial and residential segments experienced a deceleration. At the same time, the depreciation in retail and office property prices has increased.

Sharp tightening in financial conditions puts the commercial real estate sector under pressure. This is especially true in regions where economic growth prospects are weak. Tighter financial conditions will have a direct impact on commercial property prices. They could also have an indirect impact on the sector by slowing economic activity, reducing demand for commercial property such as shops, restaurants, and industrial buildings.

Confronting Commercial Real Estate Challenges with Technology

As discussed recently in

Forbes, technology can provide property owners and developers with the data they need to face these industry challenges. Collecting, storing, and organizing accurate and updated property data allows executives to make better business decisions. By embracing technology and innovation, we can address our challenges and create a better future for the real estate industry.

To learn more about how ID Plans technology can help you manage your properties, please

contact us today to schedule a demo.